This spring about two million college students will graduate and begin seeking employment. The market will be flooded with young adults with many of them seeking their first grown-up job.

Many will be competing with other grads in industries where the employers have the luxury of being very selective on who to hire. In some cases, wannabe employees may face an unlevel playing field.

The US Citizenship and Immigration Service has a program that provides a financial incentive for employers to hire foreign college graduates instead of Americans. It’s called the Optional Practical Training Program. According to the USCIS:

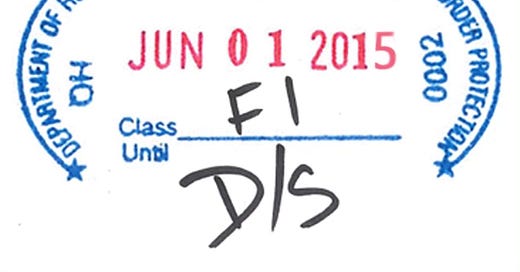

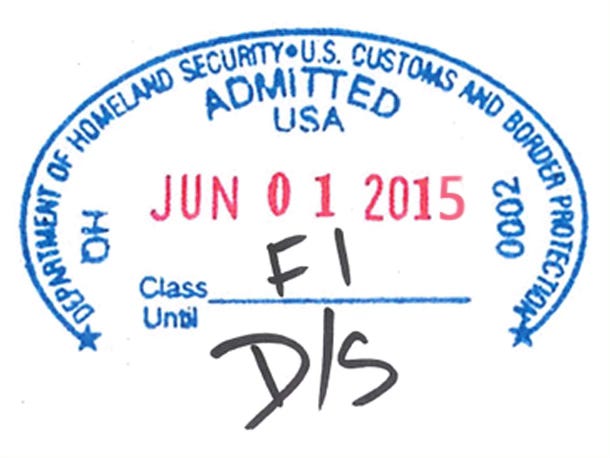

Optional practical training (OPT) is temporary employment that is directly related to an F-1 student’s major area of study. Eligible students can apply to receive up to 12 months of OPT employment authorization before completing their academic studies (pre-completion) and/or after completing their academic studies (post-completion).

The F-1 visa is issued to foreign students who attend an academic institution such as a high school, college, seminary or conservatory. Those students approved for participation in the OPT program may work up to 20 hours a week while a student, and full-time during school breaks or after graduation.

The intent of the OPT program is to allow a foreign student to get practical experience in their academic field before returning to their home country.

Foreign students are eligible for up to 12 months of OPT employment while a student, after graduation, or a mixture of both.

An F-1 visa holder who graduates from a US college in science, technology, engineering or math can have their visa extended for an additional 24 months for a total of three years of OPT employment.

USCIS explains:

If you have earned a degree in certain Science, Technology, Engineering and Mathematics (STEM) fields, you may apply for a 24-month extension of your post-completion OPT employment authorization if you:

· Are an F-1 student who received a STEM degree included on the STEM Designated Degree Program List;

· Are employed by an employer who is enrolled in and is using E-Verify; and

· Received an initial grant of post-completion OPT employment authorization based on your STEM degree.

However, an F-1 visa holder is not limited to a maximum of three years of OPT. According to an ICE instruction “[a]n F-1 student who has attended a … certified college, university, conservatory, or seminary on a full-time basis for at least one academic year may be authorized for up to 12 months of OPT per education level” [emphasis added].

This means a foreign student with a STEM degree can receive an undergrad degree, get approved for 12 months of OPT, receive the 24 month extension for a total of three years, then return to school for a master’s degree, and repeat the process for another three years of employment.

In some cases, a visa holder may work for more than 6 years under the OPT program. There is a rule referred to as the “cap gap.” An OPT employee whose F-1 visa expires before the start date of a pending H-1B visa falls under a grace period where the F-1 visa is automatically extended to bridge the gap to when the H-1B visa starts.

The H-1B visa is a non-immigrant visa that allows employers to temporarily hire foreigners in specific fields under certain conditions. Some employers will hire F-1 visa holders as they near the end of their OPT employment. The H-1B visa has been abused over the years by companies laying-off American workers in favor of lower-salaried foreigners.

This is how the OPT program adversely affects the ability of American college graduates to get hired. An F-1 visa holder is not eligible to receive Medicare and Social Security. Accordingly, they are exempt from payroll tax deductions where 6.2% of the employee’s income is deducted for Social Security and 1.45% for Medicare taxes. Likewise, the employer does not have to pay the 7.65% combined payroll taxes on behalf of the worker. This means it costs an employer nearly 8% less to employ a foreigner.

According to US tax code, an F-1 visa holder in the US for 5 years or more qualifies as a resident alien for tax purposes. As such, they must meet all tax obligations, including paying Medicare and Social Security payroll taxes. In some cases, these resident aliens are eligible for Medicare and Social Security benefits even if they do not possess a green card.

But the OPT program provides an exception for this category of resident aliens. The OPT program exempts both the student and the employer from paying payroll taxes if the F-1 visa holder is employed by the academic institution attended.

According to the IRS:

Section 3121(b)(10) of the Internal Revenue Code provides another exemption from FICA (Social Security and Medicare) taxes for all students, regardless their U.S. tax residency status. Under this special exception rules, Social Security and Medicare taxes do not apply to services performed by students employed by a school, college, or university where the student enrolled at least half-time [emphasis added]. The student’s on-campus employment must be incidental to and for the purpose of pursuing a course of study. Consequently, a foreign student who become a resident alien may be eligible for exemption if qualified. Off-campus jobs or working for other employers do not qualify. Revenue Procedure 2005-11 provides instructions for determining who is eligible for the "student FICA exemption."

If the foreigner works at IBM then payroll taxes must be deducted. But no payroll taxes are due if the foreigner is employed by Harvard. In other words, a college has a financial incentive to hire a foreigner rather than an American to work for the school.

According to FWD.us, there were 276,452 foreigners enrolled in the OPT post-completion program in 2023.

Mark Hyman is a 35-year military veteran and an Emmy award-winning investigative journalist. Follow him on Twitter (X) at @markhyman.

Mark welcomes all news tips and story ideas in the strictest of confidence. You can reach him at markhyman.tv (at) gmail.com.